EUR/USD Outlook: Dollar Strength Faces BOJ Rate Hike Speculations

XAU/USD

Prediction: Slight Decrease

Gold prices are showing signs of correction in this morning’s trading session as tensions in the Middle East ease, reducing the demand for safe-haven assets. However, the market is closely monitoring President Donald Trump's economic policies and the Federal Reserve's interest rate outlook, which could influence gold’s next move.

FUNDAMENTAL ANALYSIS

Spot Price: Currently, spot gold is trading at $2,696.18/ounce, down 0.2% on the day. U.S. Gold Futures: Trading at $2,734.90/ounce, down 0.5%. Middle East Situation: A ceasefire agreement between Israel and Hamas has weakened demand for gold as a safe-haven asset.

Federal Reserve’s Monetary Policy: The Fed is expected to keep interest rates unchanged in the January 29 meeting and may start cutting rates from March 2025, which could support gold prices in the medium term.

U.S. Economic Data: Investors are awaiting signals from inflation reports and the Consumer Price Index (CPI) to assess the likelihood of Fed rate cuts.

Dollar Index (DXY): The U.S. dollar is slightly strengthening, adding pressure on gold prices.

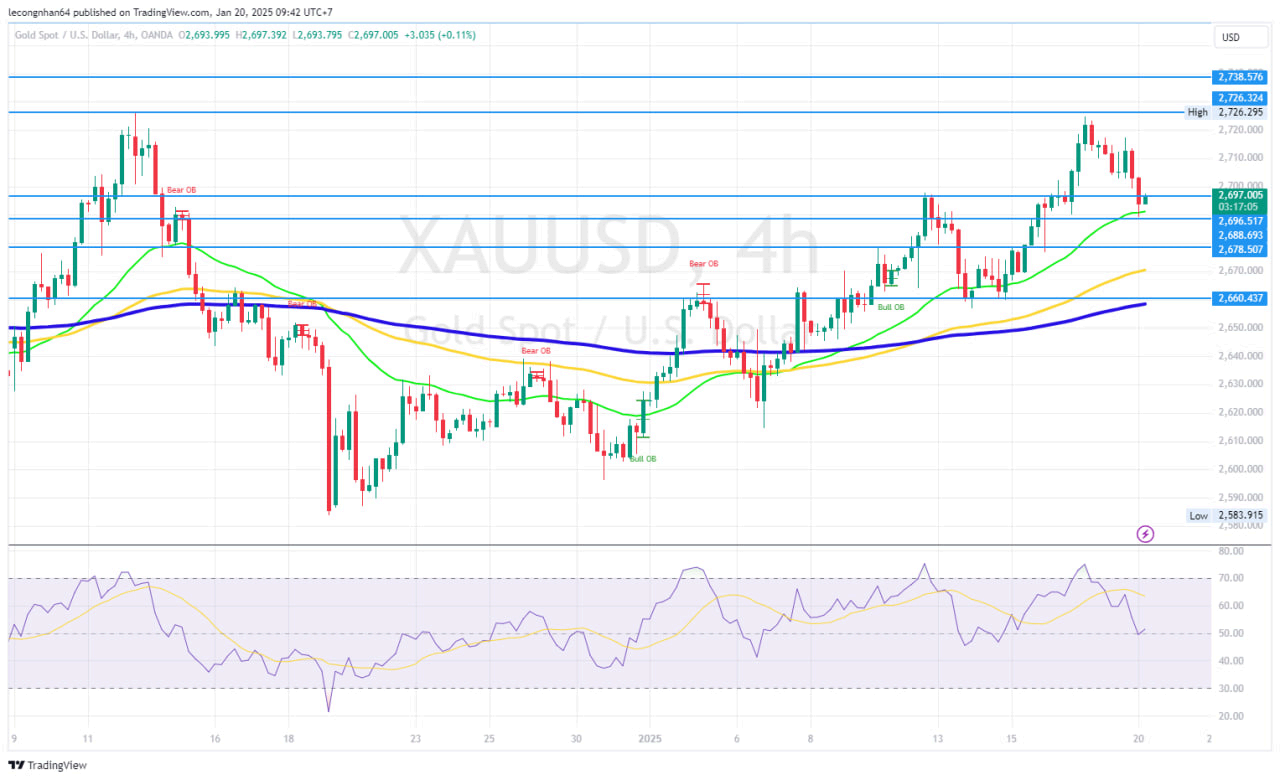

TECHNICAL ANALYSIS

Key Resistance:

● $2,700 - $2,710: Strong resistance zone; a breakout could lead to a test of $2,726 - $2,738.

Key Support:

● $2,691 (EMA 34): A break below this level could push prices down to $2,678 - $2,660 (EMA 200).

RSI: Currently at 51, indicating a neutral stance, with no overbought or oversold signals.

EMA: The short-term EMA indicators still support an uptrend, but a break below the EMA 34 level could lead to a deeper correction

Gold may continue to correct in the short term, but the overall trend remains bullish as long as the $2,678 - $2,660 support zone holds. Investors should closely monitor upcoming U.S.

economic data and Fed signals to determine a suitable trading strategy.

EUR/USD

Prediction: Sideways – Potential Downtrend

The EUR/USD exchange rate is fluctuating within a narrow range as the market awaits trade policy decisions from the Trump administration and the Bank of Japan (BOJ) interest rate decision. The U.S. dollar remains strong due to solid economic data, but political developments could introduce volatility.

FUNDAMENTAL ANALYSIS

Current Exchange Rate: EUR/USD is trading around 1.02887, nearly unchanged from the previous session.

Dollar Index (DXY): The USD continues to strengthen as expectations of new tariffs under Trump could support the U.S. economy while pressuring the euro.

BOJ Monetary Policy: The BOJ is expected to raise interest rates this week with an 80% probability, which could impact capital flows and reduce the attractiveness of the USD, indirectly

supporting EUR/USD.

Trump’s Trade Policy: If the U.S. imposes high import tariffs, capital could shift away from risk assets, increasing demand for the USD.

TECHNICAL ANALYSIS

Key Resistance:

● 1.03218 - 1.03398: Nearest resistance, aligning with EMA 89.

● 1.03749: Strong resistance level; a breakout could trigger further upside momentum.

Key Support:

● 1.02221: Nearest support; a breakdown could push the price towards 1.01766.

RSI: Currently at 50.37, indicating a neutral market stance with no overbought or oversold

Signals.

EMA: The pair remains under bearish pressure as the price stays below both the EMA 89 and EMA 200. EUR/USD may continue to trade sideways in the short term within a 1.02221 - 1.03398 range.

AMbreak below 1.02221 would confirm a bearish trend, opening the path to 1.01766. Conversely, if the pair surpasses 1.03398, it could test the 1.03749 region. Investors should closely monitor announcements from the Trump administration and the BOJ’s interest rate decision to determine the next trend direction.

BTC/USD

Prediction: Correction – Uptrend Still Dominant

Bitcoin has undergone a correction after reaching a high of $106,294, dropping close to $100,000 before experiencing a slight recovery. Currently, BTC is retesting the key support zone

around $99,198 - $100,000.

FUNDAMENTAL ANALYSIS

Current Rate: BTC/USD is trading at $101,506, down approximately 4.5% in the past 24 hours.

Key Market Events Impacting BTC:

● Memecoin Rotation: The TRUMP memecoin dropped 30% as funds shifted to MELANIA, which surged 24,000%.

● Trump's Crypto Strategy: Trump is expected to sign a strategic executive order on Bitcoin after taking office, boosting crypto interest.

● Altcoin Boom Prediction: Coinbase forecasts an upcoming altcoin surge, which could temporarily weaken BTC's dominance.

Impact on BTC:

● Short-Term Bearish: Capital shifting to altcoins may apply short-term pressure on BTC.

● Long-Term Bullish: Pro-crypto policies could support BTC's long-term uptrend.

TECHNICAL ANALYSIS

Key Resistance Levels:

● $102,216: Immediate resistance; a breakout could push BTC back to $106,294.

● $106,807 - $108,364: Strong resistance zone; a breakthrough would confirm the continuation of the uptrend.

Key Support Levels:

● $99,198: Closest support; a breakdown could lead to $97,665.

● $90,437 - $89,164: Deeper support zone if selling pressure intensifies.

RSI: Currently at 47, indicating that bearish momentum is present but not yet in the oversold Territory.

EMA: BTC remains in a long-term uptrend as the price is still above the EMA 89 and EMA 200.

Bitcoin is in a short-term correction, but the long-term trend remains bullish. If BTC holds above $99,198, it is likely to rebound toward $102,216 - $106,294. However, if it loses $99,198, a retest of $97,665 is possible. Traders should closely monitor price action around the $100,000 level to determine the next strategic move.

Disclaimer

Derivative investments involve significant risks and may result in the loss of the capital you invest. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.