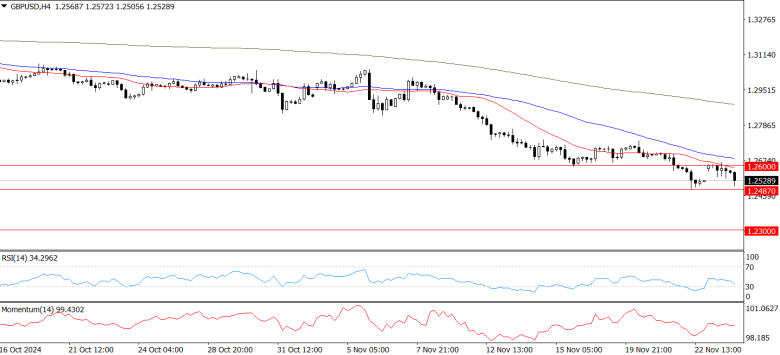

GBP/USD Analysis: Eyeing 1.2300 as Long-Term Bears Take Control

GBP/USD

Prediction: Decrease

Fundamental Analysis:

The UK’s economic calendar is light this week, with limited data releases, while the U.S. will see key inflation data on Wednesday. The improving global risk appetite has slightly weakened the U.S. Dollar, giving the Pound a modest boost, keeping GBP/USD just below the 1.2600 level. With limited data from the UK, and most of the U.S. market focus on Tuesday and Wednesday ahead of the Thanksgiving holiday, the market could remain relatively stable. The Federal Open Market Committee (FOMC) will release its Meeting Minutes on Tuesday, providing insights into the Fed’s interest rate decisions.

Technical Analysis:

GBP/USD remains below 1.2600, stabilizing above 1.2500 after dropping from its early-November range near 1.3000. The pair recently hit a six-month low of 1.2487. In the short term, bulls may attempt a recovery toward the 200-day Exponential Moving Average (EMA) at around 1.2840. However, long-term bears may target the 2024 lows near 1.2300.

Disclaimer

Derivative investments involve significant risks and may result in the loss of the capital you invest. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.