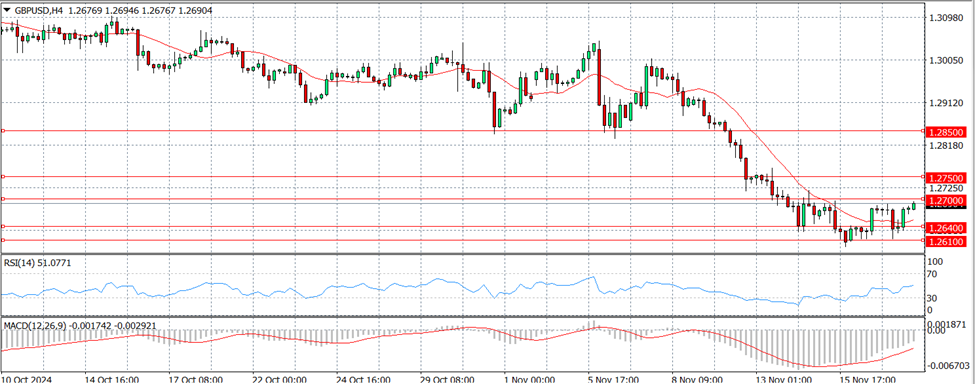

GBP/USD Struggles Below 1.2700 Ahead of Key UK Economic Data

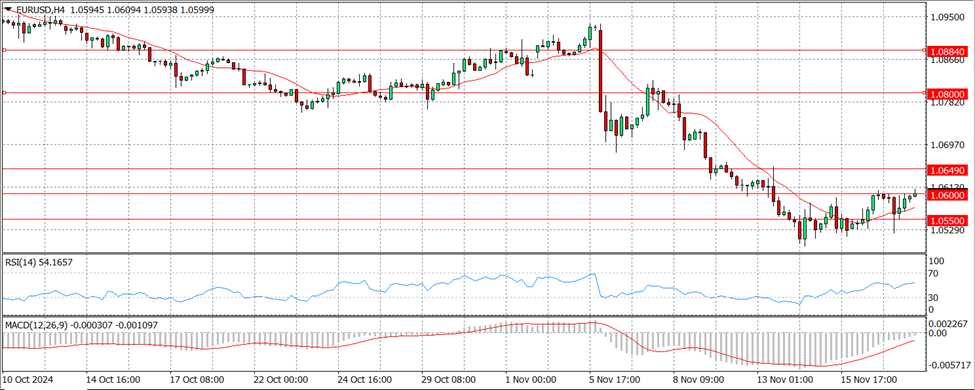

EURUSD

Prediction: Increase

Fundamental Analysis:

The EUR/USD pair traded between 1.0550 and 1.0600 on Tuesday, briefly testing lower levels before rebounding to close the day up by 0.14%. Final pan-European Harmonized Index of Consumer Prices (HICP) inflation data had minimal impact on market sentiment, as the year-over-year October HICP remained at 2.0%, matching initial estimates. The U.S. market faces a relatively quiet economic data schedule this week. ECB President Christine Lagarde is set to speak on Wednesday at the ECB’s Conference on Financial Stability, amid ongoing concerns over persistent inflation and economic disparities. On Thursday, the U.S. is expected to see a moderate rise in Initial Jobless Claims, while PMI data is due on Friday.

Technical Analysis:

Since peaking above 1.1200 in September, EUR/USD has fallen by approximately 6.5%, touching lows near 1.0500 before a mild recovery to around 1.0600. Despite this slight rebound, the pair remains in a bearish trend, trading well below its 200-day Exponential Moving Average (EMA), which is near 1.0900. Recent bearish momentum has driven the 50-day EMA beneath the long-term average and may further decline toward 1.0800. If the current upward trend weakens, market participants should be mindful of potential reversals near the still-declining 50-day EMA.

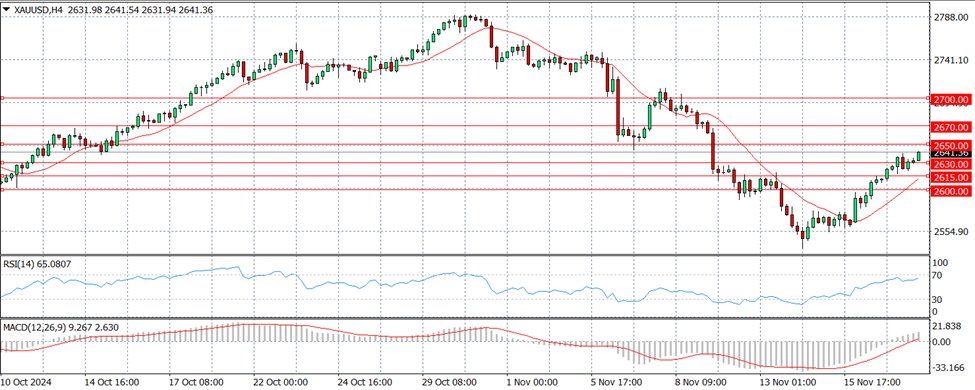

XAUUSD

Prediction: Increase

Fundamental Analysis:

Gold prices are maintaining levels above $2,600, approaching $2,650 early Wednesday due to rising geopolitical tensions linked to the Russia-Ukraine conflict and a dip in U.S. Treasury yields. Investor concerns over these tensions have spurred demand for safe-haven assets like Gold, leading to increased positions. Gold recently surpassed the $2,600 mark, facing immediate resistance near the 55-day Simple Moving Average (SMA) around $2,640.

Additionally, a weaker U.S. Dollar is providing further support to Gold’s rally. Reports that the Biden administration has permitted Ukraine to deploy U.S.-made weapons against Russia have intensified tensions. Speculative traders have also cut back their net long positions in Gold to around 236,500 contracts, the lowest since early June, potentially signaling a change in market sentiment.

Technical Analysis:

The XAU/USD daily chart reveals a solid break above the bullish 100-day SMA close to $2,550, near November’s low of $2,536. The weekly high around $2,540 aligns with the 55-day SMA, strengthening this initial resistance area. The next target lies at the November 5 weekly high of $2,749.

However, a quick drop below the 100-day SMA at $2,551 could shift the focus to the November low at $2,536.

Short-term 4-hour chart analysis indicates further recovery potential, as the Relative Strength Index (RSI) has risen but faces resistance around 62. The Average Directional Index (ADX) at 32 points to weak trend momentum. Key resistance levels include $2,639, followed by the 200-SMA at $2,678, while strong support remains at $2,536, a critical area to watch in case of a decline.

GBPUSD

Prediction: Increase

Fundamental Analysis:

On Tuesday, GBP/USD traded just below the 1.2700 mark as traders geared up for critical UK economic data expected on Wednesday, including the release of October's Consumer Price Index (CPI) inflation figures. With limited U.S. economic releases in focus, the market's attention shifted to data that could influence the Bank of England's (BoE) monetary policy decisions, particularly any potential rate cuts this year. During its recent Monetary Policy Report Hearings, the BoE struck a cautious note, describing current interest rates as "moderately restrictive," leading to traders assigning a less than 20% likelihood of another rate cut in the near term.

UK CPI inflation is projected to increase to 2.2% year-over-year for October from the previous 1.7%, alongside an anticipated month-over-month rise of 0.5%. However, core UK CPI is expected to decline slightly, ranging between 3.1% and 3.2%. Additional economic indicators, such as the Producer Price Index (PPI) and Retail Sales data, will also offer a broader view of the UK's economic landscape. Meanwhile, U.S. data releases remain subdued until later in the week, when Initial Jobless Claims are expected to show a slight increase on Thursday, followed by the S&P Purchasing Managers Index data on Friday.

Technical Analysis:

Despite finding some temporary support, GBP/USD remains in a bearish trend, struggling below the 1.2700 threshold and facing resistance around the 50-day Exponential Moving Average, near 1.2850. The pair has been under sustained selling pressure, having declined by 6.23% since reaching its high of 1.3434 in September. The persistent downward momentum highlights market caution, with price action still grappling with key resistance levels. This environment poses challenges for bullish traders seeking signs of a reversal, as the overall trend continues to lean bearish, keeping the pair anchored in lower price territory.

USDJPY

Prediction: Increase

Fundamental Analysis:

In the Asian session on Wednesday, USD/JPY has retreated somewhat, trading below the 155.00 mark. Contributing factors include a generally weaker U.S. Dollar, cautious sentiment across markets, and speculation around potential Japanese intervention, all of which are restraining the pair’s upward momentum. The ongoing conflict between Russia and Ukraine is impacting risk appetite, which has helped bolster the Japanese Yen as a safe-haven asset.

While the Yen has surrendered some of its recent strength, USD/JPY is trending towards the mid-154.00s ahead of the European trading session. Investor uncertainty regarding the Bank of Japan’s next interest rate decision, combined with a positive risk sentiment, is weighing on the Yen. Meanwhile, renewed buying interest in the U.S. Dollar has driven the pair about 50 pips higher from levels below 154.00. Investors also believe that policies under U.S. President-elect Donald Trump may spur inflation, decreasing the likelihood of additional easing measures by the Federal Reserve—a factor lending support to the Dollar. However, potential Japanese intervention, ongoing geopolitical risks, and declining U.S. Treasury yields may curb any significant losses for the Yen and cap further USD/JPY gains.

Technical Analysis:

From a technical perspective, USD/JPY’s failure to sustain a position above 155.00 on Monday, followed by a subsequent pullback, poses a cautionary signal for bullish traders. Support could emerge around the 153.85 mark, with daily chart indicators still showing some positivity. If selling pressure intensifies, the pair may slide towards 153.25 and then 153.00, with critical support located near the 152.70-152.65 range. A decisive drop below this area could expose the 200-day Simple Moving Average, now serving as support near 151.90-151.85.

On the upside, the 155.00 threshold and the recent peak around 155.35 represent initial resistance levels. A strong move past 155.35 would strengthen the bullish outlook, positioning USD/JPY to test 155.70, with a potential extension towards 156.00 and the multi-month high of 156.75 reached last Friday.

Disclaimer

Derivative investments involve significant risks and may result in the loss of the capital you invest. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.