GBP/USD Consolidates Near 1.2600 Amid Downtrend Pressure and Mixed Sentiment

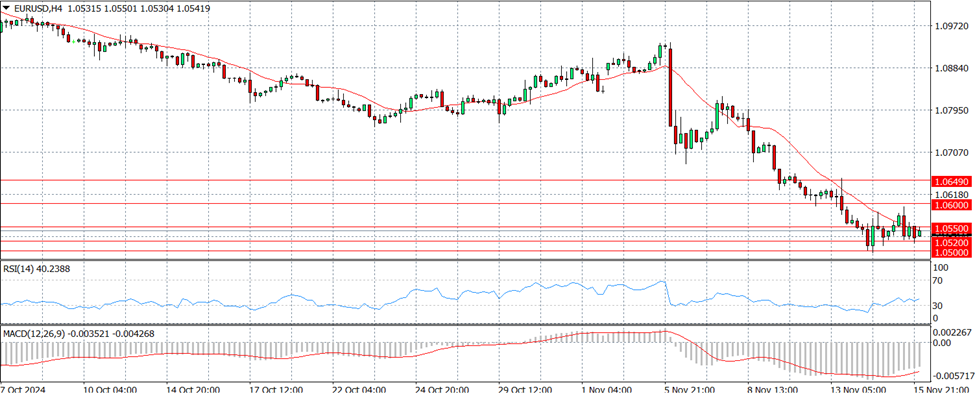

EURUSD

Prediction: Decrease

Fundamental Analysis:

The EUR/USD pair is trading near 1.0550 in the Monday Asian session, hovering close to its yearly low of 1.0496 from November 14. Downside risks have increased due to cautious remarks from Federal Reserve officials and stronger-than-anticipated U.S. Retail Sales figures, which bolster the U.S. Dollar's strength. Last week, Fed Chair Jerome Powell tempered expectations for swift rate cuts, citing robust economic conditions, a strong labor market, and persistent inflation. Powell remarked, "The economy is not signaling that we need to rush to lower rates."

According to the CME FedWatch Tool, there is nearly a 60% likelihood of a 25-basis-point rate cut by the Fed in December. October Retail Sales data, released by the U.S. Census Bureau, showed a 0.4% increase, surpassing the 0.3% forecast. Additionally, the NY Empire State Manufacturing Index surprised with a rise to 31.2, defying an expected decline of 0.7 and highlighting strong manufacturing activity.

Technical Analysis:

The Euro remains under downward pressure as the European Central Bank (ECB) takes a dovish stance, with expectations of a rate cut in December. Eurozone headline inflation is projected to drop to 2.4% in 2024 from 5.4% in 2023 and continue easing to 2.1% in 2025 and 1.9% in 2026. The European Commission's Autumn 2024 forecast maintains a 0.8% growth outlook for the Euro Area in 2024, although the 2025 projection has been slightly lowered to 1.3% from the previous 1.4%. Growth is expected to reach 1.6% in 2026. EU Economy Commissioner Paolo Gentiloni noted that declining inflation, increased private consumption, and investment, coupled with record-low unemployment, should foster gradual growth over the next two years.

XAUUSD

Prediction: Increase

Fundamental Analysis:

Gold prices have rebounded to around $2,570, recovering from a six-day losing streak during early Asian trading on Monday. However, further gains may face resistance due to the strong U.S. Dollar. The Dollar's appreciation following Donald Trump's election win could exert selling pressure on USD-denominated gold. Anticipated inflationary policies linked to Trump's administration have dampened expectations for rate cuts in the near future. Market sentiment regarding a December rate cut has weakened, especially after Federal Reserve Chair Jerome Powell signaled no urgency for further reductions, pointing instead to robust economic conditions. Rising interest rates typically reduce gold's appeal since it does not offer any yield.

Technical Analysis:

Gold recently dropped below the October 10 swing low of $2,603, extending losses past $2,600 and briefly touching a two-month low at $2,536, just below the 100-day Simple Moving Average (SMA) of $2,545. Sellers' inability to push prices further down to $2,500 has opened the door for a potential rebound. The immediate resistance level is at $2,600. If buyers succeed in reclaiming this level, they may aim for the 50-day SMA at $2,651, followed by additional resistance near $2,700. A move beyond this point could target the November 7 high of $2,710. The Relative Strength Index (RSI) has moved away from its neutral zone, indicating bearish momentum, which may continue to put downward pressure on XAU/USD.

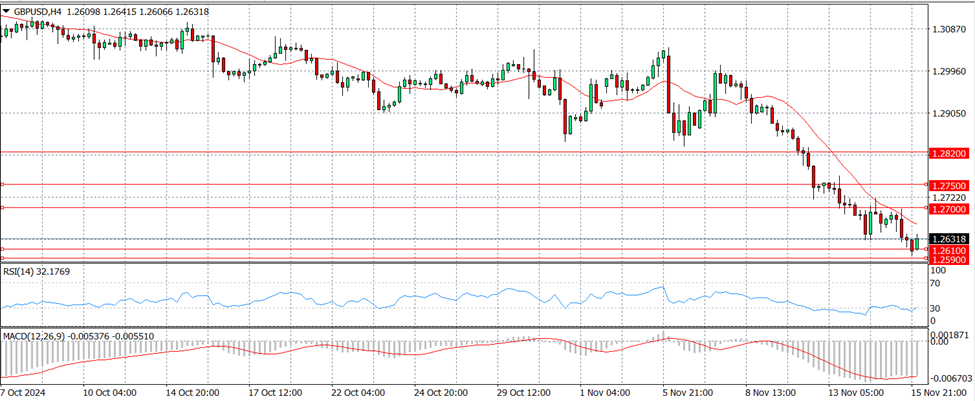

GBPUSD

Prediction: Decrease

Fundamental Analysis:

The GBP/USD pair began the week on a quiet note, consolidating just above the 1.2600 level, which marks the lowest point since mid-May, reached last Friday. Currently, the pair has paused a six-day losing streak, supported by a slight retreat in the U.S. Dollar. However, the broader outlook points to a continuation of the prevailing downtrend.

While the USD remains weak and is trading below last Thursday's yearly high, its recent surge following the U.S. elections suggests that major declines may be limited. Market expectations surrounding President-elect Donald Trump's policies, which could boost inflation and limit future Federal Reserve rate cuts, have driven U.S. Treasury yields higher, indicating further USD strength in the near term.

On the other hand, the British Pound faces headwinds due to uncertainty around the Bank of England’s monetary policy decisions. Economic data revealed a slowdown in UK wage growth (excluding bonuses) in September, alongside an uptick in the unemployment rate from 4.1% to 4.3%.

Additionally, the UK GDP unexpectedly contracted in September for the first time in five months. While this has raised expectations for potential BoE rate cuts, officials have signaled no immediate changes for the December meeting.

Technical Analysis:

The GBP/USD pair's bearish bias is reinforced by trading below the 200-day Simple Moving Average (SMA). A daily close beneath the key support level at 1.2664, the August 8 swing low, would likely pave the way for additional declines. The subsequent support zones include 1.2600, the May 9 cycle low at 1.2445, and the year-to-date low at 1.2299.

On the upside, if GBP/USD moves above 1.2700, the next resistance is located at the 200-day SMA near 1.2817. A break above this level would expose further resistance at 1.2900.

Technical indicators, such as the Relative Strength Index (RSI), indicate potential consolidation as the RSI approaches oversold territory and begins to flatten.

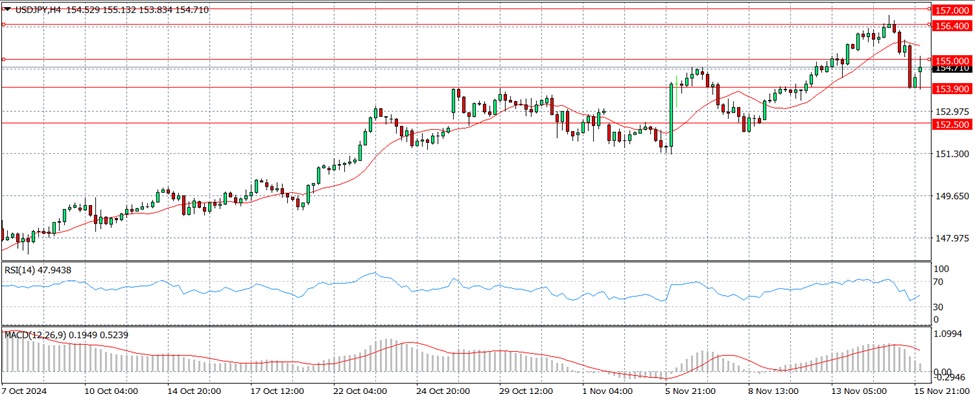

USDJPY

Prediction: Increase

Fundamental Analysis:

USD/JPY remains above the 154.00 level as the week begins, pausing its retreat from Friday’s high, which marked its strongest position since July 23. Speculation surrounding potential intervention and remarks by Bank of Japan (BoJ) Governor Kazuo Ueda regarding a possible December rate hike lend some support to the Japanese Yen. However, the downside appears restricted due to sustained bullish momentum for the U.S. Dollar.

On Friday, the Japanese Yen ended a four-day losing streak but quickly came under pressure following Japan’s Q3 Gross Domestic Product report. The GDP showed quarter-on-quarter growth of 0.2%, down from 0.5% in the previous quarter, while annual growth was a slightly better-than-expected 0.9%. Finance Minister Katsunobu Kato underscored plans to curb excessive currency movements, emphasizing the importance of market stability. Meanwhile, Economy Minister Ryosei Akazawa anticipates a gradual recovery but flagged potential global economic headwinds as a risk.

Technical Analysis:

Currently trading near 156.50, USD/JPY shows a strong bullish trend on the daily chart, moving within an ascending channel. The 14-day Relative Strength Index (RSI) is hovering just below 70, indicating a positive outlook. Should the RSI exceed 70, overbought conditions could emerge, possibly prompting a downward correction.

On the upside, the pair may target the channel's upper boundary around 159.70. Breaking through this level would further bolster the bullish sentiment, potentially pushing the pair toward its four-month high of 161.69, recorded on July 11.

Support levels are noted at the nine-day Exponential Moving Average (EMA) near 154.65, followed by the channel’s lower boundary around 153.90.

Disclaimer

Derivative investments involve significant risks and may result in the loss of the capital you invest. You are advised to carefully read and study the legality of the company, products, and trading rules before deciding to invest your money. Be responsible and accountable in your trading.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.